There are two intertwined themes that define unionized government in California. First, funding government retiree pensions will soak up every new source of tax revenue they will ever collect. Second, cloaking new taxes and fees – and new agencies – in the virtuous raiment of environmentalism will deflect criticism and demonize critics. Here’s why:

Now that Democrats have a super-majority in California’s state legislature, expect to see plentiful new taxes to pile onto the $5.0 billion in new state and local taxes that were approved by voters on November 8th. After all, California’s projected 2017-18 state budget still has a $1.6 billion deficit. And that’s nothing. Here is a look what sort of deficit challenges California’s state and local governments are actually facing:

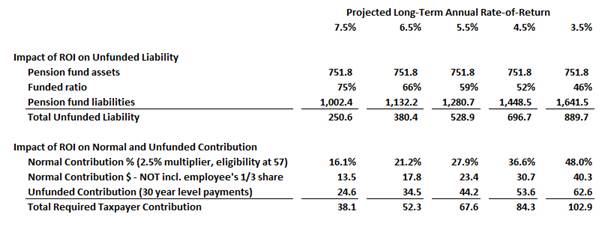

California State/Local Pension Funds Consolidated

Est. Funding Status and Required Contributions at Various ROI

During 2015, California’s state and local governments combined contributed about $34 billion to their employee pension funds. As can be seen on the chart, even if those funds could earn 7.5% per year, on average, year after year, for the next several decades, they were $4.0 billion short. At 6.5% returns, which is the new rate projection that CalPERS is adopting, they were $18 billion short. At 5.5% returns, which is the rate used by the credit rating agency Moody’s when evaluating the fiscal health of cities and counties, they were $33 billion short. Every year.

During 2015, California’s state and local governments combined contributed about $34 billion to their employee pension funds. As can be seen on the chart, even if those funds could earn 7.5% per year, on average, year after year, for the next several decades, they were $4.0 billion short. At 6.5% returns, which is the new rate projection that CalPERS is adopting, they were $18 billion short. At 5.5% returns, which is the rate used by the credit rating agency Moody’s when evaluating the fiscal health of cities and counties, they were $33 billion short. Every year.

As reported in the Los Angeles Times, California Democratic lawmakers are proposing a 17-cents-per-gallon gas tax increase, indexed to inflation, and a diesel tax increase of 30 cents per gallon. This assault on consumers joins California governor Brown’s proposal to add $65 to the annual Vehicle Fee.

As for environmentalism – what better reason to increase the vehicle license fee, or increase the tax on gasoline? From an extreme environmentalist’s perspective, it’s every bit as much a “sin tax” as the new taxes on sodas and cigarettes. And there’s real money to be had – over $2.0 billion per year on the license fees and over $7.0 billion per year on the gasoline taxes. As for fixing roads? Move over. The pension funds are between $4.0 and $33.0 billion short, or more, depending on who you ask. Per year.

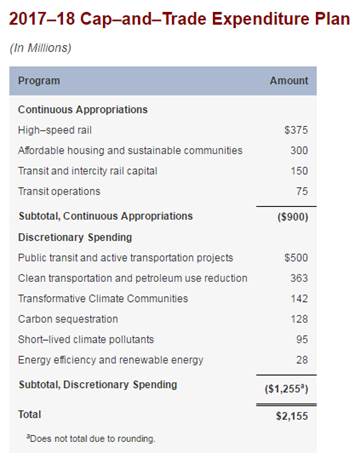

Another “green” source of revenue that has the potential to contribute billions to the coffers of unionized government are California’s new “cap and trade” fees, quietly implemented over the past few years. Here, from the state budget summary, are how some of these funds are proposed to be spent next year:

Here are three additional points that exemplify the chain of cause and effect, linking the interests of public sector unions, environmentalists, and (very counter-intuitive) the Wall Street establishment.

- Politicians controlled by public sector unions declare new infrastructure – freeways, utility upgrades, improved water infrastructure, upgraded grid, investment in airports and seaports, etc., to be environmentally unsound. The real reason, however, is they want the tax revenue to go to increasing pay and benefits for public employees.

- Environmentalists come up with a “market-based” way to curb dangerous greenhouse gasses, an “emissions auction” plan, which in turn (1) enables Wall Street trading firms to collect a fee on literally every BTU of fossil fuel consumed in America, and (2) empowers public sector agencies to redefine their jobs (mass transit workers, firefighters, code inspectors, teachers – even police since crime increases during hot weather) as coping with, educating about, or mitigating the effects of global warming, allowing these government agencies to collect the proceeds of the emissions auctions.

- Without an endlessly appreciating asset bubble, every public employee pension fund in the United States would go broke. To pump up this asset bubble, environmentalist restrictions artificially accelerate price appreciation for land, housing, gasoline, electricity, and other basic needs. And of course, financial institutions reap spectacular profits during periods of rapid asset appreciation, and property taxes go up.

There’s nothing wrong with reasonable environmental regulations. Nobody wants to go back to the 1970’s, when the air in California’s coastal cities was dangerously polluted. But these new laws aren’t cleaning our air. They’re making it impossible to build homes, or roads, or civil infrastructure. They’re hyper-regulating our industries – right down to trying to control how often our dairy cows burp. They are becoming as tyrannical as they are absurd.

The next time your state legislator or your local elected official comes up with a a new tax or fee they justify on environmentalist grounds, follow the money. Because ALL new taxes and fees end up in the pension funds, paying for retirement packages worth far more than the average taxpayer can possibly hope to achieve.

* * *

Ed Ring is the vice president of policy research for the California Policy Center.