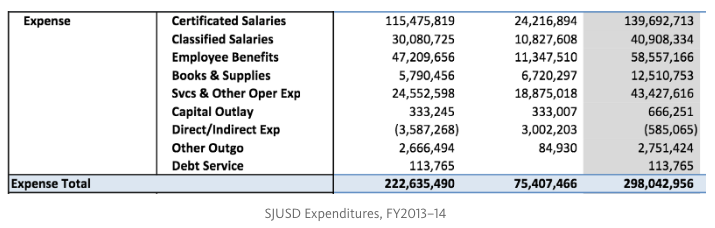

Normally, California school districts don’t face financial stress when state revenues are robust. Usually that stress arises only when state revenues shrink as a result of declining stock markets. But schools in California are experiencing stress right now despite record revenues from a long bull market and a tax increase. One illustration is the San Jose Unified School District, which just issued a report required of all districts by the Education Code*. To start, look at SJUSD’s expenditures in fiscal year 2013–14:

Notice the $58.557 million expense for “Employee Benefits,” which are payments for pensions, retiree healthcare and other benefits. Next, look at the same chart for the following fiscal year:

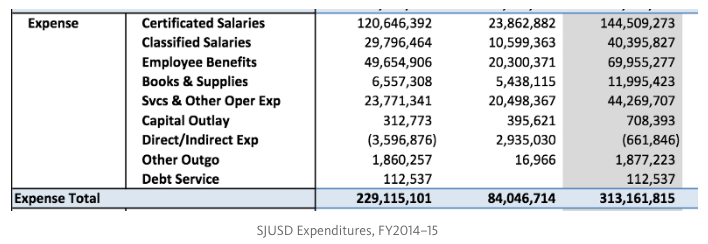

Just one year later, the cost of Employee Benefits rose 19 percent to $69.955 million. The $11 million increase in spending consumed nearly half of SJUSD’s revenue increase that year. Next, look at SJUSD’s projection for fiscal year 2019–20, just three fiscal years from now:

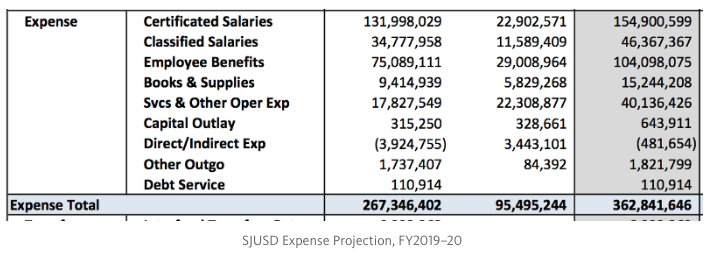

Employee Benefits costs are expected to rise an additional 49 percent, to $104 million. That aligns with scheduled pension payment increases listed on page 11 of the report.

That rapid cost growth — from less than $60 million per year to more than $100 million per year in just six years — is stressful enough but it will get worse. That’s because the unfunded liability for teacher pensions has grown an additional 33 percent since a 2014 bailout already forced districts to double pension spending and the unfunded liability for other school district employees has more than doubled since 2011. On top of that, the pension funds managing pension assets are unlikely to earn the returns they project, portending even greater liabilities and therefore more costs for districts.

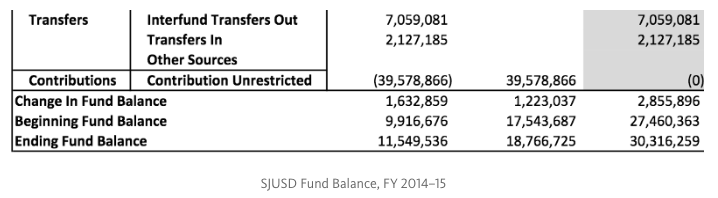

Notice also what happens to Fund Balances. SJUSD ended 2014–15 with $30 million in its General Fund even after transferring out nearly $5 million:

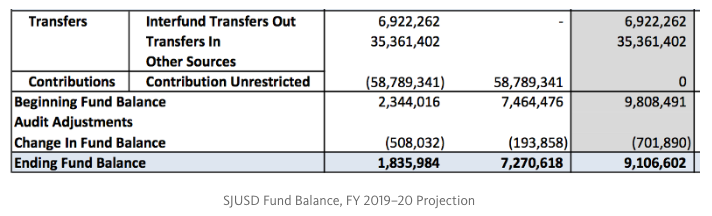

But five years later SJUSD projects a Fund Balance of only $9 million, and even that tiny sum is after transferring in a net $29 million from unnamed sources:

Believe it or not, SJUSD’s report still earns a “positive” certification. That’s because it expects to pay its bills for the current and next two fiscal years by shortchanging current students and teachers. Worse off are “Qualified” certification districts, which host more than 1 million students, including in LA, San Diego and Oakland. They expect they may not meet financial obligations for the current or next two fiscal years — and that’s after already shortchanging students and teachers.

K-12 public education ranks at the very top of citizen interests. It is California’s largest enterprise. It hosts six million schoolchildren emerging into a highly competitive world. Its ultimate authorities are state legislators and the governor. Each and every one of them should be aware that even under the current robust budgetary circumstances California’s schools are already shortchanging students and teachers. This year the cost of Employee Benefits will consume 25 percent of SJUSD’s revenues, nearly one-third more than just three years ago. That cost is already en route to consuming even more of SJUSD’s budget, and that will get worse when the bull market ends and tax revenues decline. As Governor Brown has repeatedly pointed out, state revenues are overdue for a correction. To protect current and future students and young and future teachers, elected officials should address rising school district retirement costs now, before the revenue tide goes out. Solutions are tough and must also include changes to pension fund governance, but they get tougher every day they delay.

*Section 42131 of California’s Education Code requires all school districts to certify their ability to meet financial obligations. A positive certification is assigned when the district expects to meet its financial obligations for the current and two subsequent fiscal years. A qualified certification is assigned when the district expects it may not meet its financial obligations for the current or two subsequent fiscal years. A negative certification is assigned when a district expects to be unable to meet its financial obligations for the remainder of the current year or for the subsequent fiscal year.