It’s common enough to discuss the high cost-of-living in California. It’s become a serious topic, at last. But for Californians who are used to paying ridiculous prices for everything, it may be helpful to present a comparison in the form of an annual family budget. How much does it cost to take care of a family of four in Los Angeles compared to Houston?

The choice of Los Angeles is logical enough. One in four Californians live there. And while Los Angeles County may be more expensive than most of California’s inland counties, it is not cheaper than Orange, San Diego, or any of the nine counties of the San Francisco Bay Area. Altogether there are over 25 million Californians living in expensive coastal counties. Two out of three Californians endure the types of prices depicted here.

The choice of Houston is also logical, not simply as a representative of cheaper Texas, but as a proxy for nearly all of the United States, with the only exceptions being those high-tax (usually coastal) metropolitan areas located in states ran by progressive Democrats. In terms of the cost-of-living, Houston is an authentic stand in for most of America.

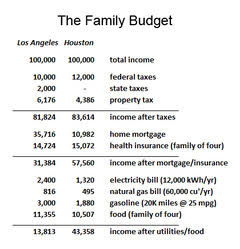

Reviewing the budget depicted below, the first thing to realize is that most people don’t have a household income of $100,000 per year. The median household income in California is $71,805. That means half of those 25 million people who have to live in places like Los Angeles have a household income that is less than $71,805. Let’s see how much it costs to a family of four to live in such a place.

As can be seen, while Texas has no state taxes, the Californian gets a bigger federal deduction because of their much bigger home mortgage payments. Very roughly speaking, these factors cancel out. But where there’s a big deduction, there’s a big payment. The median price of a home in Los Angeles is a larcenous $617,000, whereas the same home in Houston will only set a family back by $189,000. Based on a 4 percent, 30 year fixed mortgage, this translates into a crippling $2,900 monthly payment in Los Angeles, vs. a manageable $915 mortgage payment in Houston.

Making house payments that low used to be normal in California. They still are in those parts of this nation, Houston included, where the progressive Democrats haven’t yet taken control. Or if the progressive Democrats have taken control – Houston, after all, is now a battleground county – they haven’t yet had enough time to ruin everything. Consider the difference: For a household with an income of $100,000 per year, in Los Angeles, the mortgage costs 36 percent of before-tax earnings. In Houston, only 11 percent.

California and Texas do not have significant differences in costs for family health insurance, but everywhere else, California costs more. Even property taxes, where Texas charges a higher rate, are nonetheless a much more significant burden to the average Californian, because the assessed value is so much higher.

Comparing the other necessities exposes additional evidence of just how difficult it is to survive in California. Electricity costs, $.20 per kWh in California vs. $.11 in Texas. Natural gas, $13.60 per thousand cubic feet in California vs. $8.25 in Texas. Gasoline? $3.75/gallon vs. $2.35. Even food is cheaper in Texas than it is in California, the supposed breadbasket of America. The food price index – as compared to the national average – is 100.4 in Los Angeles, 92.9 in Houston.

Altogether, the average family of four in Los Angeles spends nearly $300 per month more on gasoline, utilities and food than they would in Houston. They spend over $2,000 per month more to keep a roof over their heads. They roughly break even on health insurance and taxes.

Imagine two hard working parents who manage to bring in $100K per year. In Los Angeles, they’ll have about $1,000 per month left, after paying for taxes and the bare necessities. They’ll need this money to pay for telephone, internet, and cable services, garbage collection and life insurance, buy and replace clothes, furniture, and appliances, make car payments, purchase car insurance, maintain their vehicles and their home, save for college tuition and their own retirements, cover medical co-pays and deductibles, and maybe dine out from time to time and take an occasional vacation. It’s not enough.

Let that sink in. A family of four can barely survive in California on a household income of $100,000 per year. One unexpected financial shock, and they are underwater.

In Houston, by contrast, this same family will still have over $3,500 per month left over after paying for taxes and the bare necessities. This is enough money to make additional purchases and payments and still have some left over for savings. A family making $100,000 per year cannot afford to live in Los Angeles, yet they can live reasonably well in Houston – or pretty much anywhere except in California and other deep blue enclaves across the land.

And what about those families that don’t make $100,000? What about households earning at the median California income of around $72,000 per year? What about single parent households, with a working mom trying to keep a roof over her family, perhaps renting a home in Los Angeles, where the average rental home costs $2,371 per month vs. $1,092 per month in Houston?

What bravery it must require to be a Californian in 2019, trying to raise a family. Trying to make ends meet. How did it come to this?

This article originally appeared on the website California Globe.