Imagine you are a donor to a non-profit organization whose board members receive gifts from employees to whom the board, without your consent, promises retirement benefits. Now the organization is asking you for larger donations to cover surging retirement spending but not disclosing the real reason more money is needed.

That describes the current situation in California as tax increases are proposed across the state to fund retirement promises never approved by voters and made by elected officials who receive donations and other political support from beneficiaries of the retirement promises. Retirement obligations to public employees in California consist primarily of pensions and reimbursement of Medicare premiums and other retiree out of pocket health costs.

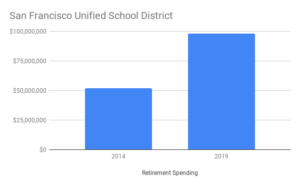

Recent examples of tax increases covering up retirement spending include a $50 million per year parcel tax increase for the benefit of San Francisco’s school district that raises an amount equal to the district’s increase in annual retirement spending:

Another is a 30 percent state income tax increase enacted earlier this decade that went to increased school spending on retirement costs. Despite that tax increase and a 10-year bull market that has lifted spending to more than $17,000 per student, California school districts are laying off teachers and suffering strikes because new money is going to increased retirement spending instead of staff and salaries.

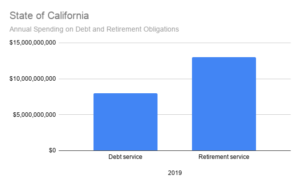

The state already spends 60 percent more on servicing never-voter-approved retirement obligations than on voter-approved debt obligations:

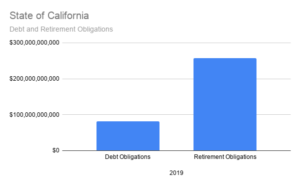

But that spread will grow because the state’s retirement obligations carry a higher blended rate of interest and dwarf the state’s debt obligations in size*:

Many more tax increases will be needed down the road to meet those obligations. Billions more in retirement obligations, also never submitted to voters, are owed by local governments and special districts.

Tax increases should improve services, not cover up legacy costs arising from obligations created by elected officials without voter consent. State legislators should require state and local governments, school districts and other public entities to submit retirement obligations to voters for approval and to provide truthful and full disclosure of the real reasons behind proposed tax increases.