The California Constitution requires the governor to submit a proposed budget (the “Governor’s Budget”) for the next fiscal year to the state legislature by January 10. The Governor’s Budget sets the table for discussions with the legislature, which must pass a budget by June 15, and is must-reading for anyone who wants to dive deep into California’s governance, as is a review of past budgets that may be accessed here. Such a review would disclose a number of interesting items:

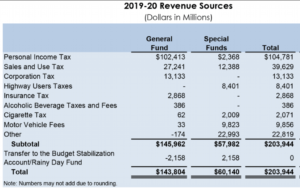

– Revenues in the current fiscal year are 80 percent greater than ten years ago. The largest source (Personal Income Tax) grew more than 100 percent.

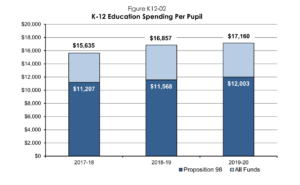

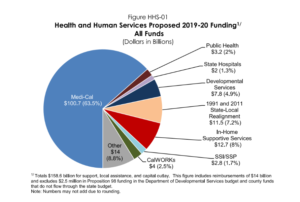

– A review of expenditures illustrates why GFC pays so much attention to the performance of K-12 and Medi-Cal (California’s version of Medicaid), which serve millions of Californians, consume the lion’s share of General Fund revenues, and all-too-often benefit special interest providers instead of customers and taxpayers.

Despite big increases in K-12 spending funded in part by a big increase in tax rates, student performance is essentially unchanged, young teachers are being laid off in some districts, and some employees have resorted to strikes because much of the new money is being diverted to unfunded retirement costs instead of salary increases.

Similarly, despite a big increase in Medi-Cal spending, public health hasn’t improved, access remains challenging, and emergency room visits are up.

We believe both K-12 and Medi-Cal could improve performance and obtain more value for money if the legislature and governor governed those systems for the benefit of customers and taxpayers.

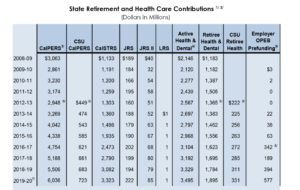

– A review would also reveal a big increase in spending on employee retirement and other benefits costs, which crowd out programs and at more than $16 billion this year are more than double their cost ten years ago.

In addition to the figures in the table above, the state made a supplemental pension contribution in 2017-18 and is in the process of providing more supplemental pension contributions over three fiscal years to help underfunded state pension funds. Supplemental pension contributions can help reduce future pension spending but take money from other priorities and the amounts being contributed are trivial compared to the massive size of unfunded pension liabilities that are accreting (growing) at extraordinary rates. As a result, absent reform, retirement spending will continue growing and crowding out programs. We believe pensions and post-employment subsidies can be reformed in ways fair to all parties.

We look forward with great anticipation to the Governor’s Budget for 2020-21.