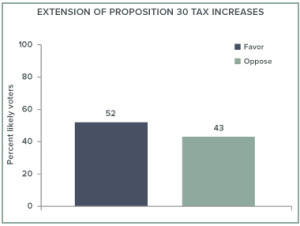

One of the most controversial issues that the governor and legislature face in 2015 is what to do about the Proposition 30 tax increase. This citizens’ initiative passed with a 55% yes vote in November 2012. The governor says this tax increase is meant to be temporary. But others say that the state budget situation has improved because of Proposition 30, and it could deteriorate if we allow the sales and income tax increases to fully expire in 2018. In the most recent PPIC Statewide Survey, 52% of likely voters would favor a Proposition 30 tax extension. We found identical results in our December 2014 poll. A slim majority of support suggests that a tax extension is in the realm of the possible but far from a sure thing.

Why the sense of urgency? Tax proponents say that the November 2016 presidential election offers the last chance for a high turnout among voters who are likely to support a Proposition 30 tax extension before its sunset in 2018. Our most recent poll confirms this view. Support for the tax extension falls short among the likely voter groups with the highest propensity to vote: Republicans (30%), whites (49%), homeowners (48%), age 55 and older (50%), and those with annual incomes of $80,000 or more (45%). Support is highest among these lower-propensity likely voter groups: Democrats (69%), Latinos (68%), those under age 35 (61%), renters (61%), and those with annual incomes under $40,000 (59%). As these numbers suggest, it would be a riskier proposition to wait until the 2018 gubernatorial election for a tax extension vote.

Many observers think that the voters will take their cues from Governor Brown if they are asked to weigh in on this issue. After all, it was the governor who brought this tax measure to the voters when the legislature failed to act. In our latest poll, most likely voters—58%— approve of the governor’s job performance, and most who approve of Brown also favor a tax extension (69%). Also, those who prefer Governor Brown’s approach to the state budget over their Democratic and Republican legislators overwhelmingly favor a tax extension (75%). In sum, Brown’s position on the tax extension will matter. But no one is certain whether he will actively support or openly oppose a tax extension in 2016.

Many observers think that the voters will take their cues from Governor Brown if they are asked to weigh in on this issue. After all, it was the governor who brought this tax measure to the voters when the legislature failed to act. In our latest poll, most likely voters—58%— approve of the governor’s job performance, and most who approve of Brown also favor a tax extension (69%). Also, those who prefer Governor Brown’s approach to the state budget over their Democratic and Republican legislators overwhelmingly favor a tax extension (75%). In sum, Brown’s position on the tax extension will matter. But no one is certain whether he will actively support or openly oppose a tax extension in 2016.

Some are looking to tweak the current Proposition 30 tax increase to gain more favor with the voters. There are calls, for example, for the creation of another temporary tax increase instead of making the Proposition 30 increases permanent. That may help gain voter support, but we have no PPIC polling data suggesting that voters supported Proposition 30 because it was temporary. Others argue that the tax on earnings over $250,000 should continue while the one quarter cent sales tax is allowed to expire. This might well improve the chances of passage and is consistent with our past polls, which show majority support for raising taxes on wealthy Californians and majority opposition to a state sales tax increase.

What is missing from this political calculus? A selling point of the Proposition 30 tax increase was its beneficiary: K-12 education. In our past polling, Californians have ranked K-12 education as their highest spending priority. However, relatively few (correctly) perceive that K-12 education is now the largest area of state spending.

Our recent poll shows that the knowledge gap is wide when it comes to the state budget: 57% of likely voters say that K-12 education is their highest priority for state spending, but just 19% are able to cite K-12 education as the largest area for state spending today. Among the likely voters whose top spending priority is K-12 education, 54% are in favor of a tax extension. Among those who think the state’s top spending category is something other than K-12 education, 56% are in favor of a tax extension. But among those who accurately say that K-12 education is the state’s top spending area, just 35% favor extending Proposition 30.

Our survey also asked what is the one issue facing California today that is most important for the governor and legislature to work on this year. Among the likely voters who named K-12 education, 65% are in favor of a Proposition 30 tax extension. In sum, the fate of a Proposition 30 tax extension in 2016, as was the case for Proposition 30 in 2012, will likely depend on how the voters perceive its effects on K-12 education.

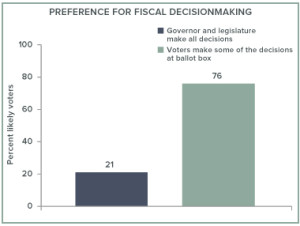

The November 2016 presidential election offers the best chance to include the most voters in this contentious issue. And, as our recent poll shows, Californians want a role in fiscal decisionmaking. An overwhelming 76% of likely voters say they prefer that voters make some of the decisions about spending and taxes at the ballot box, while just 21% say that they want the governor and legislature to make all of these decisions. Why not give the voters a chance to hear the pros and cons in a debate that can also help increase knowledge about the budget and give them the role they want to determine California’s future?

Cross-posted at PPIC.